Writtle 2017 Annual Report and Accounts

Chairman’s statement

I am pleased to report another year of significant growth in trading profits in our continuing businesses. There was one successful acquisition in the year and no disposals. The year ended with Writtle holding record cash balances and no debt, enabling another increase in ordinary dividends to shareholders and a further share trading opportunity.

Results and dividends

Turnover from continuing operations was £65.82m (2016: £60.96m) and profit before tax from continuing operations was £5.48m (2016: £3.66m).

There were no exceptional profits on disposals in the year (2016: £5.19m). Net cash at the year-end was £10.87m (2016: £7.04m).

The directors are recommending a final dividend of 10.5p (2015: 9.25p) making total ordinary dividends for the year of 15p (2016: 13p).

With no disposals in the year, there was no special dividend in the year (2016: 50p).

Subject to shareholders’ approval, the final dividend will be paid on 31 May 2018 to shareholders on the register at 28 March 2018.

Principal activities

Writtle is a UK-centred marketing services group with an international client base.

For reporting purposes we group our businesses into three headings: Innovation, Implementation and Instore, which describe their principal marketing focus. Writtle also has a property company which owns the freehold properties from which some of its companies operate.

Writtle’s model continues to be based on equity involvement and decentralised growth. Whether a group company was a start-up or acquired, Writtle will typically hold a majority shareholding alongside management which creates a motivational structure. Writtle looks for businesses in the media and marketing communications sector which can demonstrate potential for further growth either organically or by acquisition, and where Writtle can add value through its experience or by funding further expansion. Growth opportunities are typically identified by operating company management rather than by the centre. However, when larger opportunities have been identified, as with the acquisition of Loewy Group, we have integrated the individual companies into Writtle by reducing the central head office and marketing function and instead promoted the individual company brands. Alongside this decentralised approach comes a re- incentivisation package for operational management through the opportunity to purchase equity on favourable terms in their companies, and participation in share option schemes in Writtle. This creates a lean head office structure as well as considerable incentives for management in their individual companies and the group as a whole.

As well as growing organically or by acquisition, Writtle will also realise shareholder value through the sale of a business when we believe we have maximised its potential and we receive

a compelling offer. This was best demonstrated by the 2016 sale of Creo Retail Marketing Limited where we had grown the business from start-up and accepted a substantial offer for the business rather than embark on a capital absorbing expansion into continental Europe where we had limited visibility.

Review of business

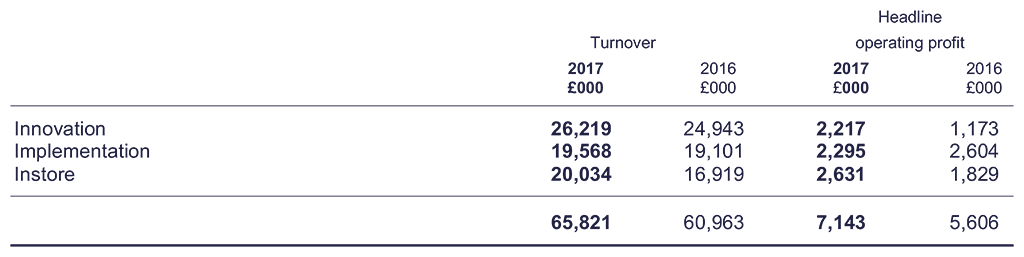

Writtle’s three business groups were all profitable and grew turnover, as the following table shows:

Our Innovation businesses showed the greatest improvement in profit over prior year with a 5.1% increase in turnover leading to a near doubling of headline operating profits. Most of the improvement took place in the second half of the year as restructuring implemented where necessary in the first half bore fruit almost immediately. Margins improved and clients finally unlocked budgets to innovate after a Brexit induced torpor. New business was secured from Pernod Ricard, Govia, Ocean Network Express, Arçelik and Tim Hortons.

Our Implementation businesses grew turnover by 2.4% but profitability was affected by increased investment in technology and personnel to underpin future growth. Profitability was nonetheless satisfactory after nearly trebling in the previous year. New business was secured from Groupe SEB and Veka.

Our Instore business achieved an 18.4% increase in turnover and 43.8% increase in profit to become Writtle’s most profitable business group. A strong focus on the resilient health and beauty market, and careful investment in equipment to increase capacity, lies behind this growth. The business has almost doubled turnover over the past three years, while improving operating profits margins each year.

Following this report, there is a short review of each of our individual operating companies written by its directors. Each operating company has its own style and, apart from overlaying similar financial controls, Writtle encourages individual company autonomy and identity.

Corporate activity

On 22 March 2017 Writtle acquired Identica Limited, a brand strategy and design agency founded over 25 years ago. The performance of Identica since acquisition has been excellent and it operates well alongside our other Innovation businesses. Financial details of the acquisition are contained in Note 26.

There will again be a share trading opportunity this year and shareholders who wish to participate, either buying or selling, should follow the guidelines in the letter accompanying this report. If there are excess shares available for sale once existing shareholder demand has been satisfied, Writtle may choose to use its Employee Share Ownership Trust (ESOT) to buy shares or offer them to new investors.

As ever, we have a number of interesting corporate developments under review, some of which, if realised, could create significant value for shareholders this year. We are primarily focussed on delivering a larger transaction that can transform our business’s scale without compromising our demanding acquisition criteria. We continue to avoid earn outs or inflated valuations, and smaller acquisitions must be considered truly outstanding, like Identica, to merit attention.

Appointment

Reflecting the continued growth of our Instore business, I am pleased to announce the appointment of Tracy Scutt, Managing Director of Arken POP International, to the Writtle board with effect from 29 March 2018.

Current trading

Writtle’s businesses operate in the fast-changing marketing communications landscape with multinational buyers demanding better value and transparency from their agencies at the same time as creative inspiration and technological prowess. Writtle’s businesses deliver on these criteria. It is a testament to the quality of our agencies and their motivated and agile management teams, that we have seen the trading momentum of 2017 continue into 2018.

I look forward to another successful year.

Robert Essex

Chairman

6 April 2018