Writtle 2021 Annual Report and Accounts

CHAIRMANS STATEMENT

I am pleased to report another satisfactory performance in the second year Writtle has been impacted by the economic downturn caused by the Covid 19 pandemic.

Once again, our management teams performed strongly in demanding circumstances. Staff wellbeing remained the priority in the face of new Covid variants yet service levels to clients were not compromised. All our businesses were profitable, and no activities were discontinued.

The result is an increase in turnover and profit, enabling Writtle to raise its annual dividend and declare a fifth Special Dividend.

RESULTS AND ORDINARY DIVIDENDS

Turnover was £67.93m (2020: £66.89m) and profit before tax was £5.19m (2020: £3.55m). The 46% increase in profit reflected the reduction of exceptional items and closure costs seen in 2020.

Net cash at the year-end was £15.13m (2020: £14.93m) as cash management continued to be prioritised.

The directors are recommending a final dividend of 13.25p (2020: 12.00p) making total ordinary dividends for the year of 20.00p (2020: 18.25p).

Subject to shareholders’ approval, the final dividend will be paid on 27 May 2022 to shareholders on the register at 31 March 2022.

SPECIAL DIVIDEND

The company’s policy is to distribute to shareholders cash balances above £5m for which the company has no immediate investment or acquisition use. With the threat from Covid receding, we have resumed acquisition discussions with previously identified targets and hope some of these bear fruit. Notwithstanding this potential use of some of our cash reserves, we are pleased to declare a Special Dividend of 50.00p per share which will be paid on 29 April 2022 to shareholders on the register at 31 March 2022.

PRINCIPAL ACTIVITIES

Writtle is an international marketing services group.

For reporting purposes, we group our businesses into three headings: Innovation, Implementation and Instore, which describe their principal marketing focus.

Writtle also has a property company that owns the freehold properties from which some of its companies operate. One of these properties was sold in the year, generating a profit of £0.66m, and it is the intention to sell the remaining property this year.

Writtle’s operating model in its group companies continues to be based on Equity Involvement and Decentralised Growth.

Equity Involvement – Whether a group company was a start-up or acquired, Writtle will typically hold a majority shareholding alongside management which creates a motivational structure where Writtle and management’s interests are aligned. Alongside traditional bonus schemes, Writtle encourages its group companies to adopt a dividend policy to reward further its management and Writtle. Additionally, to encourage collaboration across Writtle group companies, Writtle has an annual share option award and encourages employee ownership of Writtle shares which are traded internally on a matched bargain basis, normally once a year. The result of this equity involvement is that managers of Writtle group companies behave like owners and have further incentive to promote the success of Writtle as a whole.

Decentralised Growth – Writtle looks for businesses in the marketing services sector which can demonstrate potential for further growth either organically or by acquisition. These businesses will typically be led by ambitious industry experts who will identify the best growth paths through their own experience. Rather than dictating policy or acquisition strategy from the centre, Writtle will support its management teams to grow their businesses, adding value through Writtle’s management experience and funding capacity.

By enabling management to part-own and plot the development of their businesses, Writtle has proved to be a highly attractive workplace for the best talent in our industry, and our results and employee retention bear witness to this.

REVIEW OF BUSINESS

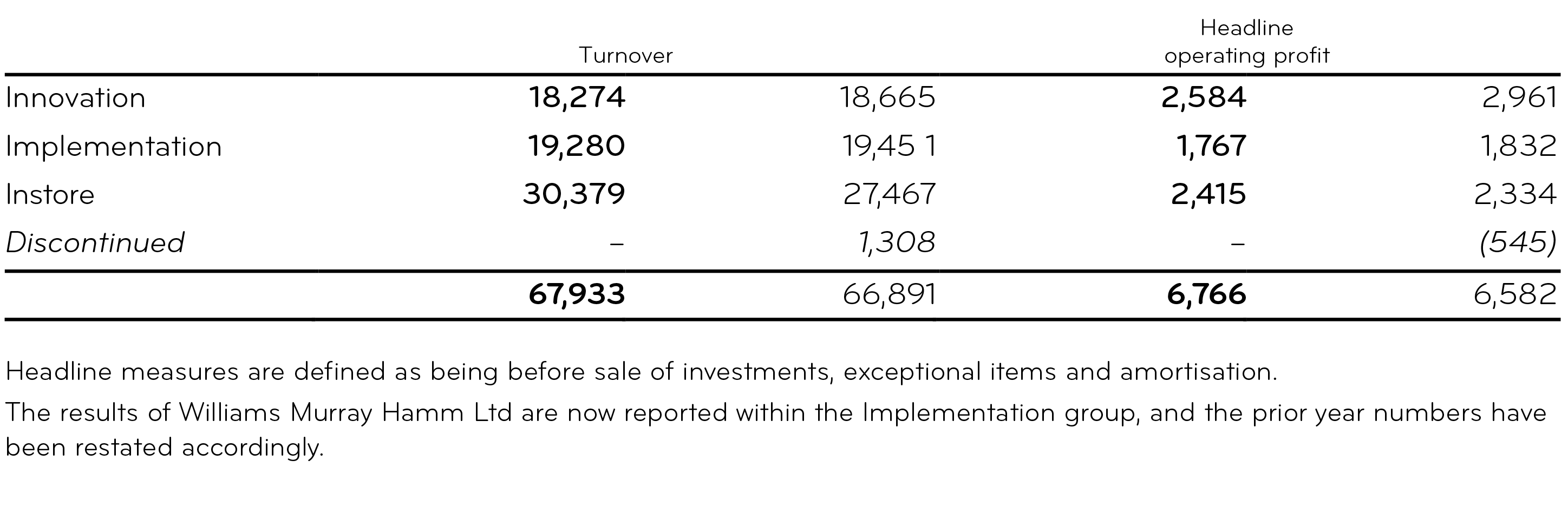

The performance of Writtle’s three business groups is shown in the following table:

Our Innovation businesses were again the best performing business group as clients were drawn to our agencies’ outstanding reputations in digital transformation, product and brand experiences, employee engagement, creativity, and strategy. Epoch again led the way with a record year, and The Team also outperformed its budget. Seymourpowell saw a quieter year as some major projects ended hence the business group’s slight underperformance overall against prior year.

Our Implementation business, Branded, was flat on prior year as its strong presence in food retail continued to counterbalance the pandemic induced inactivity in our travel, high street, and hospitality clients. We expect Branded to bounce back strongly as travel and hospitality re-open. Continued investment was made in Branded’s proprietary technology system with clients such as Amazon and Kingfisher now using its workflow, approvals, digital asset management and reporting tools.

Our Instore businesses, Arken and Fero, continued to exceed expectations in the harshest trading environment, with several retailer clients remaining closed until the second quarter. Both businesses saw the usual seasonal uplift in the second half to increase turnover and profit over prior year, but Fero’s performance was remarkable. Having been the hardest hit of all Writtle’s businesses by the pandemic, and loss making in the first half of 2020, Fero completed its turnaround in the second half of 2021 and saw profits exceed £1m for the year. I don’t usually single out individual companies for special praise, but I must make an exception for Fero this year.

For more details of individual operating company activity throughout the year, please refer to the reviews which follow this statement. Apart from overlaying similar financial controls, Writtle encourages individual company autonomy and identity, and the reviews reflect the character of each business. Writtle is also supporting each of its businesses to achieve B Corp Certification as part of the group’s ongoing commitment to meet the highest standards of social and environmental performance, transparency and accountability, and this initiative has been greeted enthusiastically by employees.

CORPORATE ACTIVITY

Writtle has resumed acquisition discussions with targets identified before the pandemic curtailed expansionary plans.

In keeping with our previously stated criteria, these transactions would be of scale, each adding sales of over £10m, and put Writtle in a position where it could consider an IPO in the next 12 months. Writtle’s track record with acquisitions and disposals since 2011 (the year we acquired Arken and Loewy Group) has been excellent with considerable value generated and a steady flow of returns to shareholders through dividends and special dividends, as the chart inside the cover of this annual report shows. Our only frustration has been not being able to complete much larger acquisitions using Writtle shares, as private company shares are considered illiquid and often valued at a discount to quoted company shares. We have addressed the illiquidity issue by offering an annual share trading facility in Writtle shares (and to date buyers have always exceeded sellers) but we have not been able to overcome the valuation discount placed on our shares, particularly when in discussions with quoted companies. We are now looking to address this issue by exploring an IPO and we have had exploratory talks with several brokers. An IPO would also give shareholders a permanent market for their shares (rather than once a year) and enable Writtle to raise money for growth through issuing new shares. Our aversion to high levels of debt or earn out funded growth is well known to shareholders and particularly vindicated by our strong performance over the last two years of the pandemic. We believe a sizeable acquisition, combined with our organic growth and track record, would give us the scale to consider an IPO on AIM within the next year and we plan to accelerate discussions with brokers and potential new shareholders should we complete such an acquisition.

A successful IPO will depend on several factors, some outside our control. One of the factors we cannot influence is the condition of investment markets, and the stock market volatility that followed recent horrific events in Ukraine is a reminder of the fragility of markets which could derail IPO plans.

With this in mind, and in case an IPO does not take place, we will again be offering a share trading opportunity this May and shareholders who wish to participate, either buying or selling, should follow the guidelines in the letter accompanying this report. If there are excess shares available for sale once existing shareholder demand has been satisfied, Writtle may choose to use its Employee Share Ownership Trust (ESOT) to buy shares or offer them to new investors.

CURRENT TRADING

The year has started well as the business world begins to return to normality with Covid restrictions being lifted. Our clients are themselves looking to dust off growth plans that have laid dormant for the past two years which has generated increased activity in our businesses. There is an air of confidence around Writtle.

At the time of writing, it is too early to say that we will not be impacted again by outside influences, especially by the war in Ukraine. However, I would like to think that our conservative approach and prudent business model over many years has left us in the best possible position to weather any further economic downturn and I look forward to another good performance this year.

Robert Essex

Chairman

14 April 2022