Writtle 2018 Annual Report and Accounts

CHAIRMAN’S STATEMENT

I am pleased to report another year of excellent growth in turnover and profits.

There were no acquisitions or disposals in the year but after the year-end we were pleased to complete the acquisition of Showcard Print Ltd (Showcard), a retail marketing services business based in Letchworth, UK on 8 April 2019, which will join our Implementation business group.

Our continued profitability meant the year ended with Writtle holding record cash balances and no debt, enabling a further increase in ordinary dividends, and we are particularly pleased to declare our third special dividend for shareholders.

RESULTS AND ORDINARY DIVIDENDS

Turnover was £70.92m (2017: £65.82m) and profit before tax was £6.73m (2017: £5.48m).

Net cash at the year-end was £12.24m (2017: £10.87m).

The directors are recommending a final ordinary dividend of 12p (2017: 10.5p), making total ordinary dividends for the year of 17.5p (2017: 15p). Subject to shareholders’ approval, this will be paid on 31 May 2019 to shareholders on the register at 28 March 2019.

SPECIAL DIVIDEND

A special dividend of 25p (2017: nil) was paid on 28 September 2018.

Notwithstanding the acquisition of Showcard completed after the year-end, the company still has significant cash balances. In keeping with the directors’ decision to distribute cash balances above £5m for which the company has no immediate investment or acquisition use, a further special dividend of 50p will be paid on 30 April 2019 to shareholders on the register at 28 March 2019, subject to shareholders’ approval.

This will be the third special dividend paid to shareholders, the second being 25p per share paid in September 2018 and the first being 50p per share paid in July 2016.

PRINCIPAL ACTIVITIES

Writtle is a UK-centred marketing services group with an international client base.

For reporting purposes we group our businesses into three headings: Innovation, Implementation and Instore, which describe their principal marketing focus. Writtle also has a property company which owns the freehold properties from which some of its companies operate.

Writtle’s model continues to be based on equity involvement and decentralised growth. Whether a group company was a start-up or acquired, Writtle will typically hold a majority shareholding alongside management, which creates a motivational structure. Writtle looks for businesses in the media and marketing communications sector that can demonstrate potential for further growth either organically or by acquisition, and where Writtle can add value through its experience or by funding further expansion. Growth opportunities are typically identified by operating company management rather than by the centre. However, when larger opportunities have been identified, as with the acquisition of Loewy Group, we have integrated the individual companies into Writtle by reducing the central head office and marketing function and instead promoted the individual company brands. Alongside this decentralised approach comes a re-incentivisation package for operational management through the opportunity to purchase equity on favourable terms in their companies, and participation in share option schemes in Writtle. This creates a lean head-office structure as well as considerable incentives for management in their individual companies and the group as a whole.

As well as growing organically or by acquisition, Writtle realises shareholder value through the sale of a business when we believe we have maximised its potential and we receive a compelling offer.

REVIEW OF BUSINESS

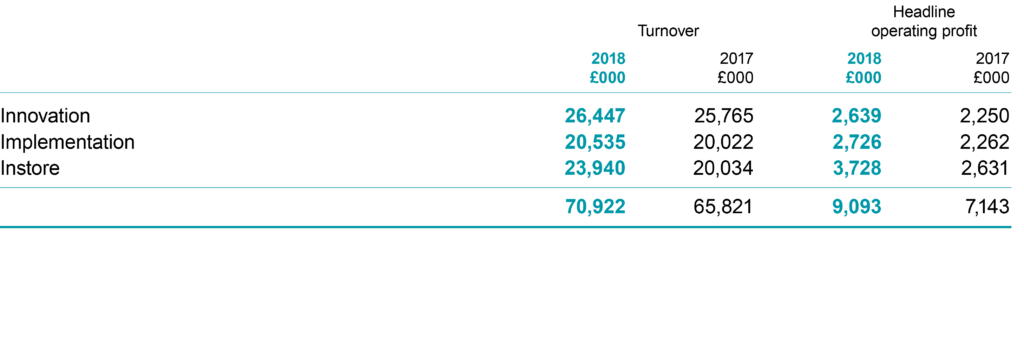

The performance of Writtle’s three business groups, all of which increased turnover and margins, is shown in the following table:

Prior year figures have been restated to include WMHAdaptive work within the Implementation group.

Prior year figures have been restated to include WMHAdaptive work within the Implementation group.

Our Innovation businesses continued the growth shown in the previous year with a 2.6% increase in turnover and 17.3% increase in headline operating profit. Outstanding individual agency performances came from Seymourpowell and Epoch, more than offsetting tougher conditions experienced by agencies operating in the hard-pressed retail sector. New business was secured from JCB, The Spaceship Company, PureGym and TSB.

Our Implementation businesses saw turnover increase by 2.6% and headline operating profit by 20.5%. The margin improvement primarily reflects the growing business collaborations and close cooperation between our Implementation businesses, which will now trade under a new group identity: Branded. Expansion in the US is under way with our US operations trading as Branded Inc. New business was secured from Costco, Jack’s, Sainsbury’s and Southeastern Grocers.

Our Instore business achieved a 19.5% increase in turnover and 41.7% increase in headline operating profit and was Writtle’s most profitable business group in 2018. A continued focus on the resilient health and beauty market, through increased investment in design and technology, underpinned this growth and more than compensated for reduced spend from other markets. We do not expect this growth in Instore to continue as high-street retailers competing in the health and beauty market have paused their investment in the light of uncertain market conditions after completing multi-year roll-outs in 2018.

Following this report is a short review of each of our individual operating companies, written by its directors. Each operating company has its own style and, apart from overlaying similar financial controls, Writtle encourages individual company autonomy and identity.

CORPORATE ACTIVITY

We reviewed a number of acquisition opportunities throughout the year and we completed the acquisition of Showcard, a UK-based retail marketing services business after the year end on 8 April 2019. Showcard is a significant business with turnover of £17m in 2018 and it will extend the range of services offered by our Implementation businesses. We have simultaneously recruited an experienced management team to grow the business. Full financial details of the transaction will be disclosed in our 2019 annual report.

We continue to be focused on larger transactions like Showcard that can transform our business’s scale without compromising our demanding acquisition criteria. Our equity-based incentivisation structures mean that we continue to avoid earn-outs and focus heavily on the additional value that can be achieved through Writtle investment and support. There is no shortage of acquisition opportunities, but with conventional wisdom suggesting that 70% of mergers and acquisitions fail to deliver an increase in shareholder value, the challenge is to identify the right targets.

There will again be a share trading opportunity this year and shareholders who wish to participate, either buying or selling, should follow the guidelines in the letter accompanying this report. If there are excess shares available for sale once existing shareholder demand has been satisfied, Writtle may choose to use its Employee Share Ownership Trust (ESOT) to buy shares or offer them to new investors.

CURRENT TRADING

Writtle’s three business groups operate in substantial but distinct sections of the marketing services sector. The demand for Innovation is unrelenting and our agencies in this sector acquit themselves well. There has been a slowdown in early 2019 as our multinational UK-based clients have adopted a ‘wait and see’ approach to Brexit in the first quarter. We have carved out a niche with our Implementation businesses and trading is forecast to be strong under the new Branded identity, with opportunities increasing following our US expansion and Showcard acquisition. Our Instore business has made a good start to the year, but we do not see it matching last year’s performance as investment in the high street slows even within its resilient health and beauty sector.

Writtle’s success has been built on a prudent acquisition policy and a focus on organic growth in our businesses, which has rewarded employees and shareholders alike. We intend to use our strong balance sheet and proven track record as a platform for further growth and take advantage of any opportunities that arise in the fast-changing marketing services sector.

I look forward to another successful year.

Robert Essex

Chairman

8 April 2019