Writtle 2023 Annual Report and Accounts

CHAIRMAN’S STATEMENT

I am pleased to report on Writtle’s results for 2023.

We saw more difficult trading conditions in the year with economic confidence shaken by inflation and further interest rate rises and Writtle was not immune to the fallout.

Our traditionally stronger second half performance duly materialised but did not fully offset the economic headwinds, most markedly in our Instore business group, and we were not able to match our prior year result. Nonetheless, all but one of our businesses were profitable and we finished the year in a strong financial position and well set to benefit from any economic upturn.

RESULTS AND ORDINARY DIVIDENDS

Turnover was £73.46m (2022: £77.17m) and headline profit before tax was £3.50m (2022: £4.39m).

Exceptional costs of £0.99m related to restructuring costs (£0.43m) as we realigned our cost base across all three business groups in light of the economic downturn, start-up costs (£0.36m) as we set up operations in the US and a final non-cash write down (£0.2m) of capitalised software development following an impairment review. After these exceptional items, share-based payment charges and goodwill amortisation statutory profit before tax was £1.70m (2022: £2.24m).

Net cash at the year-end was £6.60m (2022: £11.96m), the main cash outflows in the year being equity dividend payments of £3.47m, fixed asset purchases of £3.45m and share repurchases of £2.06m.

The directors are recommending a final dividend of 15.00p (2022: 14.00p) per share making total ordinary dividends for the year of 22.00p (2022: 21.00p) per share.

Subject to shareholders’ approval, the final dividend will be paid on 31 May 2024 to shareholders on the register at 27 March 2024.

Given the economic climate and potential acquisition opportunities that may arise from it, directors did not consider a special dividend this year.

PRINCIPAL ACTIVITIES

Writtle is an international marketing services group.

For reporting purposes, we group our businesses into three headings: Innovation, Implementation and Instore, which describe their principal marketing focus.

Writtle’s operating model in its group companies continues to be based on Equity Involvement and Decentralised Growth.

Equity Involvement – Whether a group company was a start-up or acquired, Writtle will typically hold a majority shareholding alongside management which creates a motivational structure where Writtle and management’s interests are aligned. Alongside traditional bonus schemes, Writtle encourages its group companies to adopt a dividend policy to reward further its management and Writtle. Additionally, to encourage collaboration across Writtle group companies, Writtle has an annual share option award and encourages employee ownership of Writtle shares which are traded internally on a matched bargain basis, normally once a year. The result of this equity involvement is that managers of Writtle group companies behave like owners and have further incentive to promote the success of Writtle as a whole.

Decentralised Growth – Writtle looks for businesses in the marketing services sector which can demonstrate potential for further growth either organically or by acquisition. These businesses will typically be led by ambitious industry experts who will identify the best growth paths through their own experience. Rather than dictating policy or acquisition strategy from the centre, Writtle will support its management teams to grow their businesses, adding value through Writtle’s management experience and funding capacity.

By enabling management to part-own and plot the development of their businesses, Writtle has proved to be a highly attractive workplace for the best talent in our industry, and our results and employee retention bear witness to this.

REVIEW OF BUSINESS

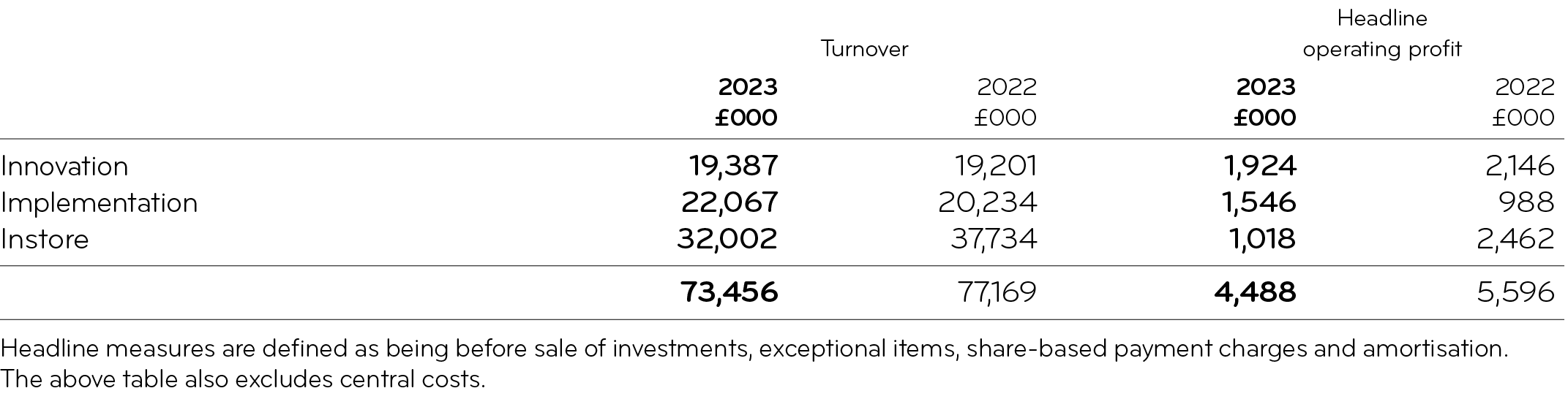

The performance of Writtle’s three business groups is shown in the following table:

Our Innovation businesses were our best performing business group, with Epoch delivering another outstanding performance as it completed a number of high-profile projects for global FMCG clients. Although overall turnover across the business group was up 1%, profit declined by 10% as inflationary cost pressures reduced margins and both The Team and Seymourpowell incurred restructuring costs addressing this issue.

Our Implementation business BRANDED continued its recovery over prior year and grew turnover by 9% and profits by 56% as the benefits from previous restructuring flowed through. BRANDED’s creative agency WMH&I led the improvement in performance as its award-winning reputation attracted further UK and international work. BRANDED made a major investment in March by opening a US office in Miami. One year on, the signs are promising with business wins including two Fortune 500 retailers secured so far.

Our Instore businesses faced several challenges with turnover falling 15% and profits reduced by 59%. Arken recorded a loss over the first half year caused by substantially reduced activity by high street cosmetics retailers. However, activity recovered well in the second half year to return an acceptable profit for the full year and the current year has started strongly. Fero suffered the loss of a major client in the third quarter which adversely impacted the anticipated end of year uplift in trading. Aggressive pricing continues to feature in Fero’s sector which is restricting profitability in the short term. Fortunately, Fero is well invested including its recent purchase of a high-speed single pass digital print machine and it has the benefit of a strong balance sheet.

For more details of individual operating company activity throughout the year, please refer to the reviews which follow this statement. Apart from overlaying similar financial controls, Writtle encourages individual company autonomy and identity, and the reviews reflect the character of each business. Writtle is also supporting each of its businesses to achieve B Corp Certification as part of the group’s ongoing commitment to meet the highest standards of social and environmental performance, transparency and accountability, and this initiative has been greeted enthusiastically by employees. Writtle now has four operating companies that have achieved B Corp Certification and others are expected to follow.

CORPORATE ACTIVITY

The current economic climate is presenting acquisition opportunities, but we are highly selective in deciding which ones to pursue. Such opportunities must meet our twin criteria of significant scale (over £10m of turnover) and our being able to add value through turnaround or investment. We are actively reviewing companies identified for acquisition although there is no guarantee that we will complete a transaction. We are keen to replicate our past successes in this area having not completed a significant corporate transaction since 2019. Past acquisitions, divestments and organic growth have rewarded shareholders well through increasing ordinary and special dividends and we are looking to resume this path.

In September one of our two Private Equity shareholders, Abry Partners, notified Writtle that they wished to sell their 11% shareholding. Writtle conducted a successful share placing amongst its shareholders and share option holders and in addition Writtle purchased and cancelled all remaining Abry Partners shares. After this share cancellation, the ownership proportion attributed to each ordinary share increased by 7%.

We will again be offering a share trading opportunity in May and shareholders who wish to participate, either buying or selling, should follow the guidelines in the letter accompanying this report. If there are excess shares available for sale once existing shareholder demand has been satisfied, Writtle may choose to use its Employee Share Ownership Trust (ESOT) to buy shares or offer them to new investors.

CURRENT TRADING

The recent fall in inflation and steadying interest rates have not yet restored demand to previous levels so actions taken by our business groups to align their overheads to lower turnover have been necessary. In the current year two of our businesses are behind our internal targets, but others are trading strongly and ahead of internal targets so I hope to report a satisfactory result at the half year.

Robert Essex

Chairman

28 March 2024