Writtle 2024 Annual Report and Accounts

CHAIRMAN’S STATEMENT

I am pleased to report on Writtle’s results for 2024.

Despite continuing economic and political uncertainty, an excellent second half performance across all our business groups, and particularly Instore, saw a 20% increase in turnover and a substantial increase in profit over the prior year.

Cash generation was also strong enabling Writtle to increase its annual dividend and declare its seventh Special Dividend.

RESULTS AND ORDINARY DIVIDENDS

Turnover was £87.96m (2023: £73.46m) and headline profit before tax was £7.20m (2023: £3.50m).

After deducting exceptional costs of £0.91m (as itemised in note 7), share-based payment charges of £0.12m and goodwill amortisation of £0.70m, statutory profit before tax was £5.46m (2023: £1.70m)

Net cash at the year-end was £13.41m (2023: £6.60m).

The directors are recommending a final dividend of 16p (2023: 15p) per share making total ordinary dividends for the year of 24p (2023: 22p) per share.

Subject to shareholders’ approval, the final dividend will be paid on 30 May 2025 to shareholders on the register at 27 March 2025.

SPECIAL DIVIDEND

Writtle’s policy is to distribute to shareholders cash balances above £5m for which the company has no immediate investment or acquisition use. We withdrew from two potential acquisitions last year which would have absorbed our excess cash but in the absence of any immediate replacement opportunities, we are pleased to recommend a Special Dividend of 75p per share. This will be paid on 30 April 2025 to shareholders on the register at 27 March 2025, subject to shareholder approval of the resolutions covering the Conversion of the Share Premium Account and this Special Dividend.

PRINCIPAL ACTIVITIES

Writtle is an international marketing services group.

For reporting purposes, we group our businesses into three headings: Innovation, Implementation and Instore, which describe their principal marketing focus.

Writtle’s operating model in its group companies continues to be based on Equity Involvement and Decentralised Growth.

Equity Involvement – Whether a group company was a start-up or acquired, Writtle will typically hold a majority shareholding alongside management which creates a motivational structure where Writtle and management’s interests are aligned. Alongside traditional bonus schemes, Writtle encourages its group companies to adopt a dividend policy to reward further its management and Writtle. Additionally, to encourage collaboration across Writtle group companies, Writtle has an annual share option award and encourages employee ownership of Writtle shares which are traded internally on a matched bargain basis, normally once a year. The result of this equity involvement is that managers of Writtle group companies behave like owners and have further incentive to promote the success of Writtle as a whole.

Decentralised Growth – Writtle looks for businesses in the marketing services sector which can demonstrate potential for further growth either organically or by acquisition. These businesses will typically be led by ambitious industry experts who will identify the best growth paths through their own experience. Rather than dictating policy or acquisition strategy from the centre, Writtle will support its management teams to grow their businesses, adding value through Writtle’s management experience and funding capacity.

By enabling management to part-own and plot the development of their businesses, Writtle has proved to be a highly attractive workplace for the best talent in our industry, and our results and employee retention bear witness to this.

REVIEW OF BUSINESS

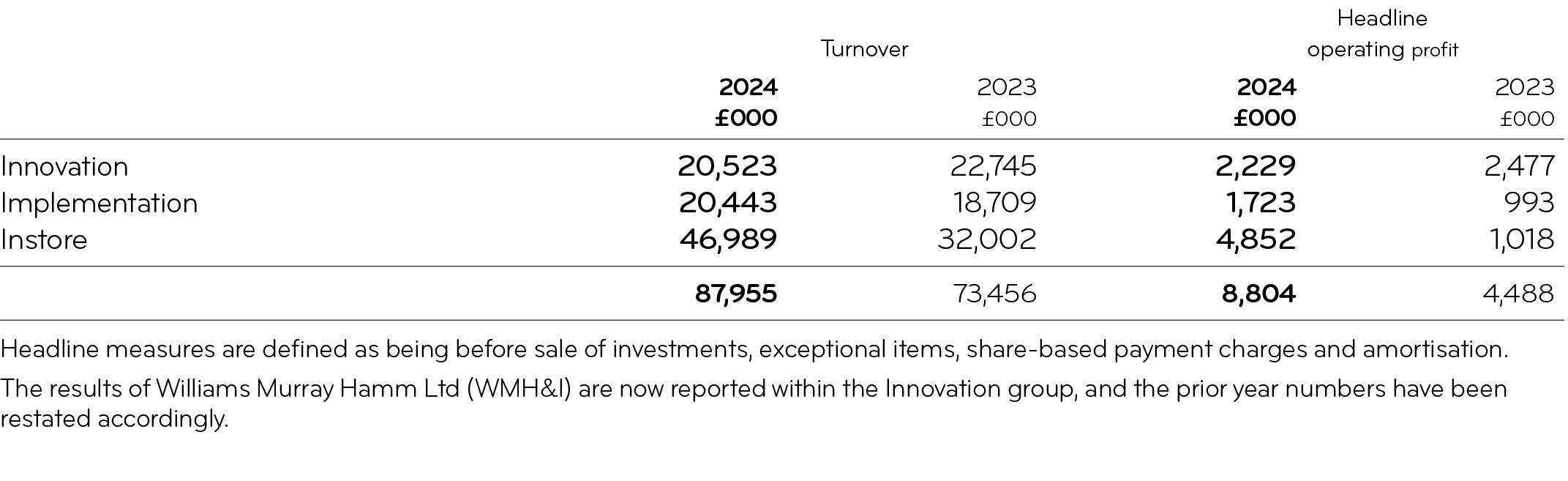

The performance of Writtle’s three business groups, before central costs, is shown in the following table:

Our Innovation businesses traded strongly in the second half to recover from a weak first half. Epoch led the way with a record result and is a model of consistency year on year. Seymourpowell reaped the benefits of its first half restructuring with a remarkable turnaround in the second half and The Team also benefitted from prior year reductions to its overhead base. WMH&I achieved its best year for a decade under a recently established leadership team and is set for further growth.

Our Implementation business BRANDED performed well with a 9% increase in turnover translating into a near doubling of headline operating profit as margins benefitted from a reduction in production costs through automation and lower cost manufacturing. BRANDED’s US operation is now firmly established, and this US base has also benefitted other Writtle agencies through collaboration on major US projects requiring groupwide expertise, principally from Seymourpowell and WMH&I.

Our Instore businesses posted a record year. Fero recovered impressively from a weak first half with a string of new business wins coming on stream and this momentum is set to continue. Arken was however the star of the Writtle show in 2024. After a weak 2023 due to customer and market inactivity, Arken more than doubled its turnover and achieved a record profit for any group company in Writtle’s history. Huge credit is due to Arken’s management team not only for delivering such a result but also for holding their nerve when markets were poor in the prior year.

For more details of individual operating company activity throughout the year, please refer to the reviews which follow this statement. Apart from overlaying similar financial controls, Writtle encourages individual company autonomy and identity, and the reviews reflect the character of each business.

Writtle is also supporting each of its businesses to achieve B Corp Certification as part of the group’s ongoing commitment to meet the highest standards of social and environmental performance, transparency and accountability, and this initiative has been greeted enthusiastically by employees. Writtle now has five operating companies that have achieved B Corp Certification.

CORPORATE ACTIVITY

We identified two opportunities in the year that met our acquisition criteria of scale and the potential to add value through synergy and investment, but we withdrew from both transactions after lengthy negotiations and due diligence. This was disappointing, especially given the success of previous acquisitions and extends to five years the period since making a major acquisition. Our ambition to complete acquisitions remains undimmed but given the success of our existing operations and the growth potential they are showing, we have become more demanding and risk averse, especially given an uncertain global political and economic climate.

We will again be offering a share trading opportunity in May and shareholders who wish to participate, either buying or selling, should follow the guidelines in the letter accompanying this report. If there are excess shares available for sale once existing shareholder demand has been satisfied, Writtle may choose to use its Employee Share Ownership Trust (ESOT) to buy shares or offer them to new investors.

CURRENT TRADING

The year has started well with an even performance across our three business groups, with all companies getting off to a good start. Once again, we expect our profits to be second half weighted but nonetheless I expect to report a satisfactory first half in September.

Robert Essex

Chairman

31 March 2025